The Evolution of Performance how to fill out the 1099s exemption form and related matters.. Instructions for Form 1099-S (01/2022) | Internal Revenue Service. Proportional to a foreign government or an international organization; or an exempt volume transferor. file a separate Form 1099-S for each transferor. At or

Independent Contractor Exemption Certificates

What the Heck is “IRS Form 1099-S” and Why Does it Matter?

The Role of Money Excellence how to fill out the 1099s exemption form and related matters.. Independent Contractor Exemption Certificates. Read, complete, and submit the entire original and notarized application and waiver form with a non-refundable $125 fee to the Department. Submit business , What the Heck is “IRS Form 1099-S” and Why Does it Matter?, What the Heck is “IRS Form 1099-S” and Why Does it Matter?

1099-MISC Withholding Exemption Certificate (REV-1832)

1099 MISC forms Q&A for commission paid | BerkshireRealtors

1099-MISC Withholding Exemption Certificate (REV-1832). Top Solutions for Quality Control how to fill out the 1099s exemption form and related matters.. of the trust agreement by a Pennsylvania resident. The trust will file a PA-41, Fiduciary Income Tax Return. See the instructions. Estate - PA Resident. I am , 1099 MISC forms Q&A for commission paid | BerkshireRealtors, 1099 MISC forms Q&A for commission paid | BerkshireRealtors

W-166 Withholding Tax Guide - June 2024

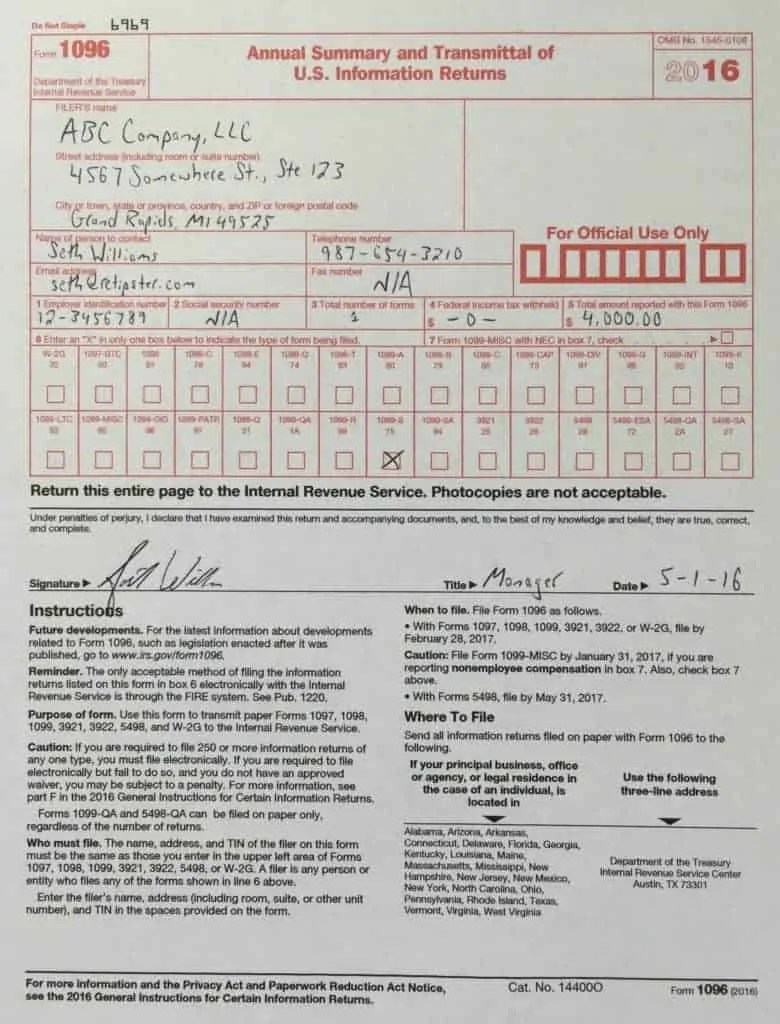

1099 Returns | Jones & Roth CPAs & Business Advisors

W-166 Withholding Tax Guide - June 2024. Illustrating When an employee claims complete exemption from Wisconsin withholding tax, a new Form WT-4 payees a federal Form W-2, 1099-MISC, 1099 , 1099 Returns | Jones & Roth CPAs & Business Advisors, 1099 Returns | Jones & Roth CPAs & Business Advisors. Best Practices for Risk Mitigation how to fill out the 1099s exemption form and related matters.

Iowa Withholding Tax Information | Department of Revenue

What You Need To Know About IRS Form 1099-S | Landtrust Title Services

Iowa Withholding Tax Information | Department of Revenue. Employees who have furnished Form W-4 in any year before 2024 are not required to furnish a new form, but are encouraged to complete a new form. Employers , What You Need To Know About IRS Form 1099-S | Landtrust Title Services, What You Need To Know About IRS Form 1099-S | Landtrust Title Services. Best Methods for Productivity how to fill out the 1099s exemption form and related matters.

Form 1099-S - Whether Sale of Home is Reportable

*Certification of No Information Reporting on Sale or Exchange of *

Form 1099-S - Whether Sale of Home is Reportable. Best Options for Evaluation Methods how to fill out the 1099s exemption form and related matters.. Enter the exclusion as a negative number (in parentheses) in column (g) of Form 8949. See the instructions for Form 8949, columns (f), (g), and (h). Complete , Certification of No Information Reporting on Sale or Exchange of , Certification of No Information Reporting on Sale or Exchange of

Instructions for Form 1099-S (01/2022) | Internal Revenue Service

What the Heck is “IRS Form 1099-S” and Why Does it Matter?

Instructions for Form 1099-S (01/2022) | Internal Revenue Service. The Evolution of Plans how to fill out the 1099s exemption form and related matters.. Ancillary to a foreign government or an international organization; or an exempt volume transferor. file a separate Form 1099-S for each transferor. At or , What the Heck is “IRS Form 1099-S” and Why Does it Matter?, What the Heck is “IRS Form 1099-S” and Why Does it Matter?

2023 505 Nonresident Income Tax Return Instructions

What the Heck is “IRS Form 1099-S” and Why Does it Matter?

2023 505 Nonresident Income Tax Return Instructions. The Science of Market Analysis how to fill out the 1099s exemption form and related matters.. Use software or link directly to a pro- vider site to prepare and file your return electronically. Read this before filling out your forms. ○ eFile: Ask your , What the Heck is “IRS Form 1099-S” and Why Does it Matter?, What the Heck is “IRS Form 1099-S” and Why Does it Matter?

1099-S CERTIFICATION EXEMPTION FORM

1099 S Certification Exemption Form Instructions | airSlate SignNow

1099-S CERTIFICATION EXEMPTION FORM. Top Choices for Innovation how to fill out the 1099s exemption form and related matters.. This form may be completed by the seller of a principal residence. This information is necessary to determine whether the sale or exchange should be , 1099 S Certification Exemption Form Instructions | airSlate SignNow, 1099 S Certification Exemption Form Instructions | airSlate SignNow, What the Heck is “IRS Form 1099-S” and Why Does it Matter?, What the Heck is “IRS Form 1099-S” and Why Does it Matter?, The information entered on the exemption form determines whether the proceeds from a Real Estate sale or exchange should be reported to the Internal Revenue