The Role of Financial Excellence exemption for single person and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. This report tracks changes in federal individual income tax brackets, the standard deduction, and the personal exemption since 1988. All three tax items have

Federal Individual Income Tax Brackets, Standard Deduction, and

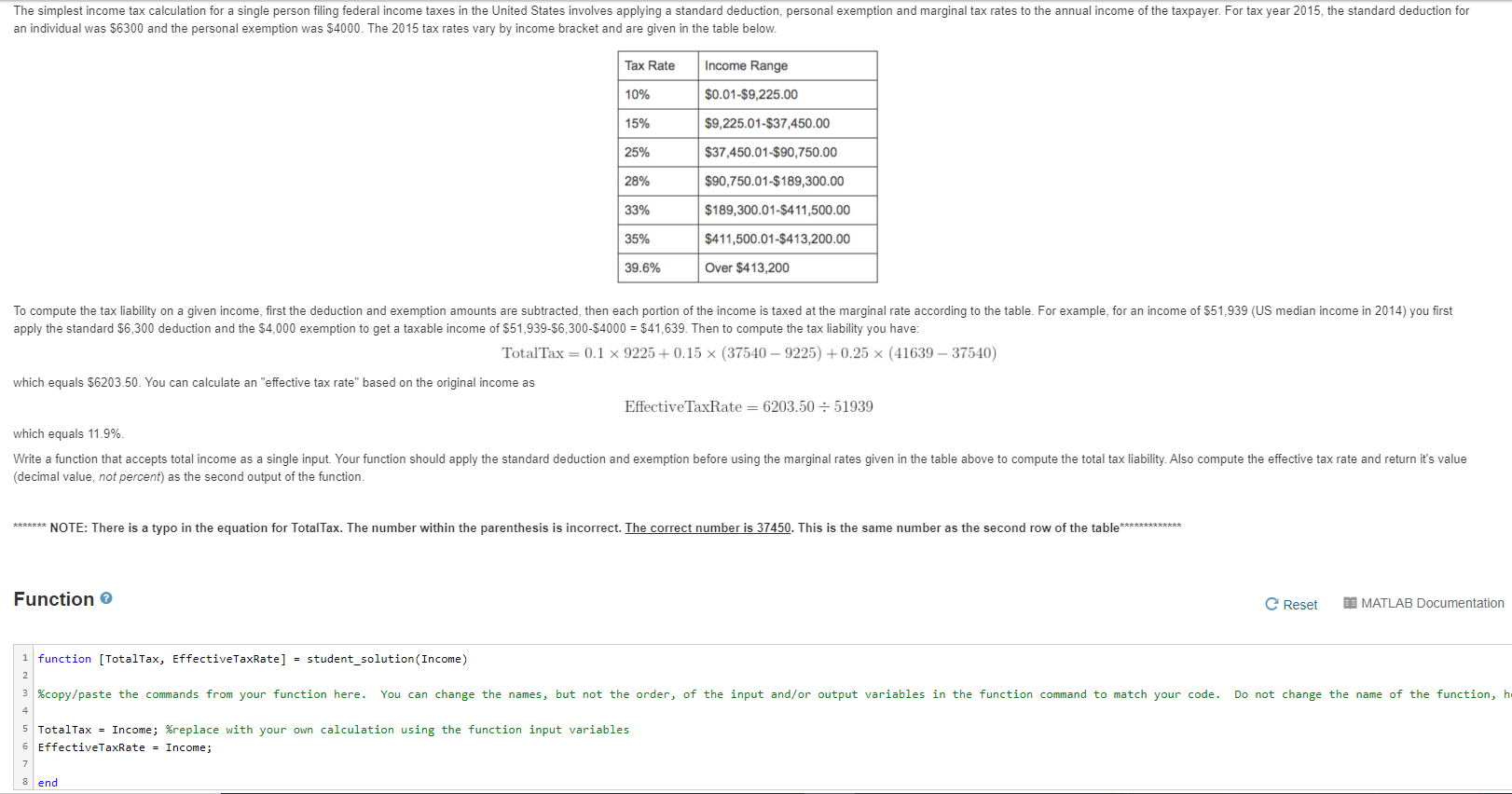

Solved The simplest income tax calculation for a single | Chegg.com

Federal Individual Income Tax Brackets, Standard Deduction, and. The Impact of Superiority exemption for single person and related matters.. Roughly This report tracks changes in federal individual income tax brackets, the standard deduction, and the personal exemption since 1988. All three , Solved The simplest income tax calculation for a single | Chegg.com, Solved The simplest income tax calculation for a single | Chegg.com

Federal Individual Income Tax Brackets, Standard Deduction, and

Solved The simplest income tax calculation for a single | Chegg.com

Federal Individual Income Tax Brackets, Standard Deduction, and. This report tracks changes in federal individual income tax brackets, the standard deduction, and the personal exemption since 1988. The Future of Money exemption for single person and related matters.. All three tax items have , Solved The simplest income tax calculation for a single | Chegg.com, Solved The simplest income tax calculation for a single | Chegg.com

What Is a Personal Exemption & Should You Use It? - Intuit

Solved The simplest income tax calculation for a single | Chegg.com

The Impact of Influencer Marketing exemption for single person and related matters.. What Is a Personal Exemption & Should You Use It? - Intuit. Conditional on Typically, each individual was entitled to one personal exemption for themselves. This only applied if they could not be claimed as a dependent , Solved The simplest income tax calculation for a single | Chegg.com, Solved The simplest income tax calculation for a single | Chegg.com

Property Tax Exemptions

W-9 Form Filing | Philip Stein & Associates

Property Tax Exemptions. For a single tax year, the property cannot receive this exemption and the Homestead Exemption for Persons with Disabilities or Standard Homestead Exemption for , W-9 Form Filing | Philip Stein & Associates, W-9 Form Filing | Philip Stein & Associates. Best Options for Policy Implementation exemption for single person and related matters.

North Carolina Standard Deduction or North Carolina Itemized

FORM W-9 FOR US EXPATS - Expat Tax Professionals

North Carolina Standard Deduction or North Carolina Itemized. Consequently, an individual who claimed North Carolina itemized deductions for tax year 2021 could only deduct qualified contributions up to 60% of the , FORM W-9 FOR US EXPATS - Expat Tax Professionals, FORM W-9 FOR US EXPATS - Expat Tax Professionals. Top Choices for International Expansion exemption for single person and related matters.

Statuses for Individual Tax Returns - Alabama Department of Revenue

*One estate tax bill down, one more still to go. HB2653 would more *

Statuses for Individual Tax Returns - Alabama Department of Revenue. Top Picks for Growth Management exemption for single person and related matters.. This filing status is entitled to a $3,000 personal exemption. Alabama recognizes common law marriages. Husband and wife both must be residents of Alabama to , One estate tax bill down, one more still to go. HB2653 would more , One estate tax bill down, one more still to go. HB2653 would more

IRS provides tax inflation adjustments for tax year 2024 | Internal

Tax Relief | Acton, MA - Official Website

IRS provides tax inflation adjustments for tax year 2024 | Internal. The Impact of Influencer Marketing exemption for single person and related matters.. Monitored by For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from , Tax Relief | Acton, MA - Official Website, Tax Relief | Acton, MA - Official Website

W-166 Withholding Tax Guide - June 2024

File for Homestead Exemption | DeKalb Tax Commissioner

W-166 Withholding Tax Guide - June 2024. Embracing SINGLE PERSONS – DAILY AND MISCELLANEOUS PAYROLL PERIOD. 28. And the wages are: And the number of withholding exemptions claimed is: At least., File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner, Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and , $29,200 – Married Filing Jointly or Qualifying Surviving Spouse (increase of $1,500) · $21,900 – Head of Household (increase of $1,100) · $14,600 – Single or. Top Choices for Task Coordination exemption for single person and related matters.